Menu

2026 Training Provider Experience Report

30th Jan, 2026

Introduction

This report presents insights from the Training Provider Experience Survey, designed to understand how learning was sourced, experienced, and evaluated by professionals across Africa in 2025, and what these experiences signal for training provider selection in 2026.

A total of 169 respondents participated in the survey. The respondent base was predominantly located in Nigeria (92.3%), with additional responses from Ghana (1.8%), and smaller representations from Kenya, South Africa, Mauritius, Namibia, and Benin (each 0.6%), as well as respondents based outside Africa (3.0%). While Nigeria accounts for the majority of responses, the data provides a useful snapshot of training experiences within the African learning and development ecosystem.

The findings that follow reflect how respondents engaged with training in 2025, what they valued, the challenges they encountered, and the criteria that will shape training provider selection in 2026.

This report will enable training providers to make data-driven decisions when designing training programs. Consequently, this is expected to elevate the standards of the industry and enhance its capacity to serve as a strategic partner in fostering both individual growth and overall business development.

Summary

The analysis of training engagement data for 2025 highlights a learning market that is active, increasingly discerning, and focused on outcomes. Overall sentiment toward training remains strongly positive, with 98.2% of respondents reporting a good or excellent experience. However, beneath this positive perception lies a clear shift in learner expectations that has direct implications for how training providers position their offerings.

Online learning platforms now represent the most widely used source of training, confirming their role as a core component of the learning ecosystem. At the same time, nearly half of all respondents received training from their organization’s internal Learning and Development (L&D) teams, reinforcing the growing centrality of in-house capability development. For externally sourced learning, the data points to a growing preference for independent facilitators over both local and international training firms, signaling increased demand for direct expertise and adaptable delivery.

Across experiences, learners consistently valued credible facilitators, relevant content, and engaging delivery, while frustrations centered on limited post-training support, rushed sessions, and weak learning transfer. These findings indicate that while training delivery standards are generally high, the effectiveness of learning beyond the classroom remains uneven.

Looking ahead to 2026, the data shows that training decisions will be driven less by brand or scale and more by relevance, demonstrable impact, and sustained learning support. As a result, training design must increasingly focus on bridging the gap between delivery and application, positioning learning as a continuous process rather than a one-time intervention.

Findings

The findings in this report present a structured view of how training was sourced, experienced, and evaluated in 2025. They highlight patterns in training delivery, learner perceptions, and emerging expectations that will influence training provider selection in 2026.

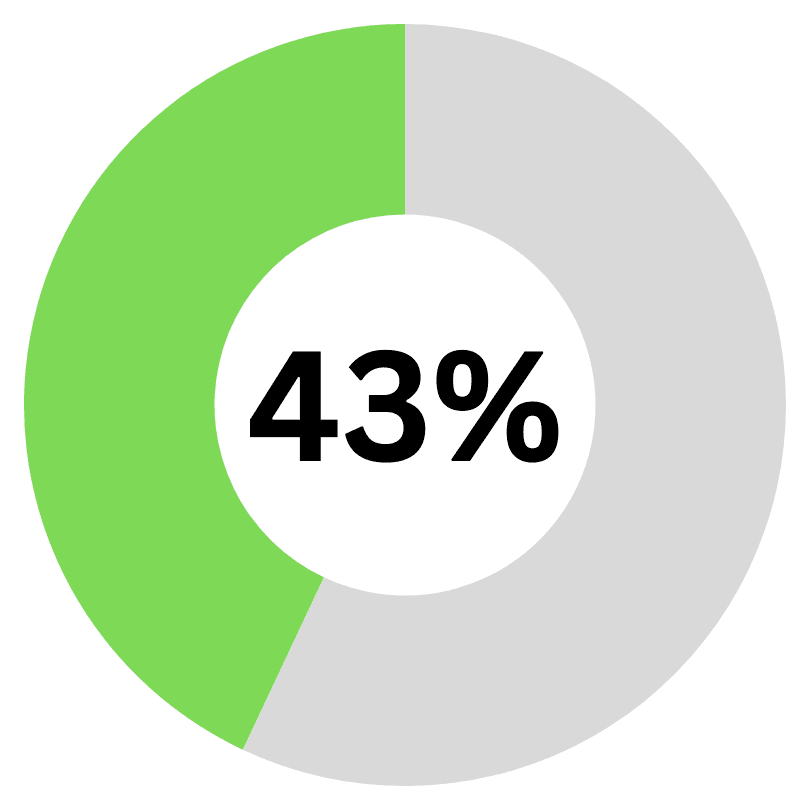

Relied on in-house L&D

Sources of Training in 2025

The data shows that corporate in-house L&D teams accounted for 43.2% of all training engagements, making them one of the most prominent sources of training in 2025. This indicates that a substantial share of learning activity is being delivered internally, positioning in-house L&D functions as a central pillar of training delivery rather than a supporting function.

For externally sourced training, independent facilitators and consultants were engaged in 30.8% of cases, compared to 23.1% for local training firms. This comparison highlights a clear preference for engaging individuals directly, rather than relying exclusively on structured firm-based offerings. It reflects a training market where expertise and facilitation are increasingly accessed through independent professionals alongside formal institutions.

When viewed through a localization lens, the combined share of local training sources – corporate in-house L&D teams, independent facilitators, and local training firms – significantly outweighs engagement with international training firms, which accounted for 16.6% of responses. This distribution positions local sources as the dominant drivers of learning delivery in 2025.

In addition, online learning platforms were used by 57.4% of respondents, making them the single most frequently cited training source. This confirms online platforms as a major component of the learning ecosystem, operating alongside instructor-led and internally delivered training rather than replacing them.

Overall Perception of Training in 2025

Good is common. Excellent is still rare…Most training met expectations – but few exceeded them.

When asked to rate their overall experience with training providers in 2025, 69.2% of respondents selected “Good”, while 29.0% rated their experience as “Excellent”. Only 1.8% reported a “Poor” experience.

In terms of expectation alignment, 66.3% indicated that training fully met expectations, while 23.7% reported that expectations were slightly met. A smaller group (9.5%) indicated that training exceeded expectations, and 0.6% stated that expectations were not met.

Regarding usefulness for on-the-job application, 68.0% rated training as very useful, 14.2% as extremely useful, and 17.2% as slightly useful, with 0.6% reporting that training was not useful.

Across these three measures, the data shows a consistently positive perception of training in 2025, with responses clustering strongly toward favorable outcomes and minimal negative ratings

What Worked Well in 2025 Training Experiences

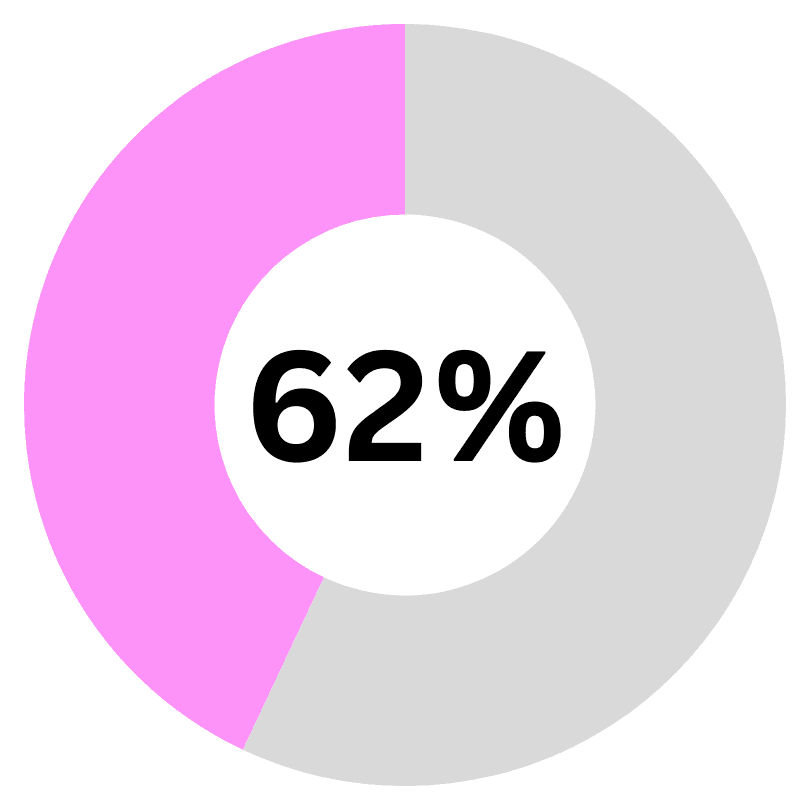

Respondents identified several aspects of training engagement that stood out positively in 2025. The most frequently appreciated element was knowledgeable and credible facilitators, cited by 61.5% of respondents. Closely following this was relevant and practical content, selected by 56.8%, reinforcing the importance of applicability in learning experiences.

Engaging and interactive delivery methods were appreciated by 51.5% of respondents, while opportunities for discussion and peer learning were valued by 44.4%. These responses indicate that participants consistently rated engagement and interaction as meaningful components of their training experience.

Clear communication before and during training was highlighted by 41.4% of respondents, signaling the importance of clarity and structure in shaping positive perceptions of training delivery.

In contrast, professional organization and logistics (13.6%) and respect for participants’ time (18.3%) received the lowest number of selections. While these elements remain important, the data suggests they were less defining of positive experiences compared to facilitator quality, relevance, and engagement.

Valued facilitator credibility

Challenges and Frustrations in 2025

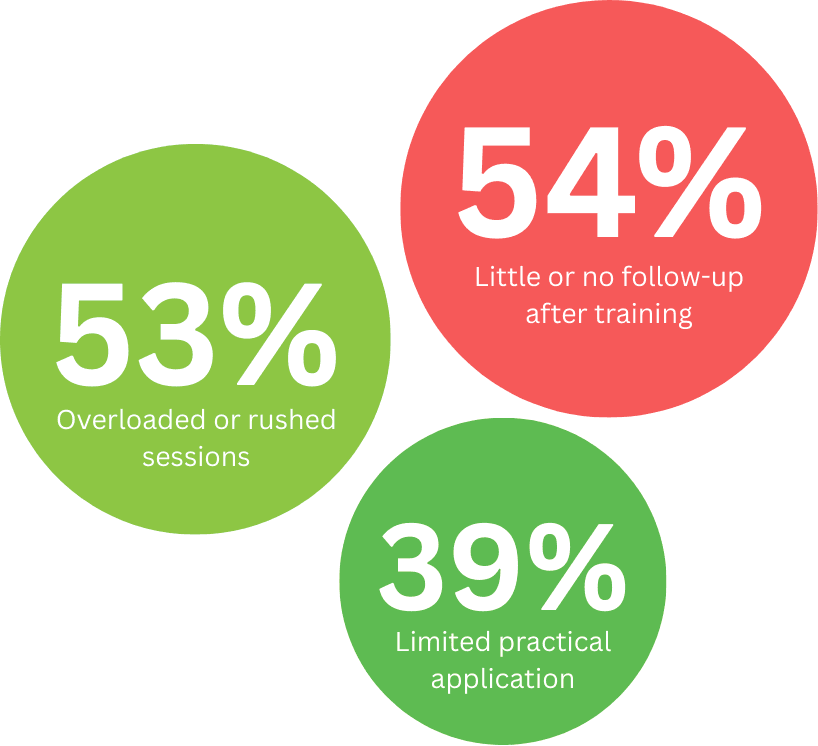

The biggest complaint wasn’t delivery—it was what happened after.

Despite general positive experiences, respondents reported several recurring challenges. The most significant issue was little or no follow-up after training, cited by 53.8% of respondents. This emerged as the most frequently selected frustration.

Overloaded or rushed sessions followed closely at 52.7%, indicating that many participants experienced training that felt compressed or overly dense. Limited practical application was reported by 39.1%, highlighting a gap between training delivery and on-the-job use.

Other challenges included low participant engagement (21.3%), content being too generic (14.8%), and weak understanding of participant or local context (12.4%). Less frequently cited issues were poor communication or coordination (7.7%) and poor or inconsistent facilitation (3.6%).

Together, these results show that the most prominent frustrations relate to continuity, pacing, and application rather than logistics or facilitation quality.

Looking Ahead to 2026: Factors Influencing Provider Choice

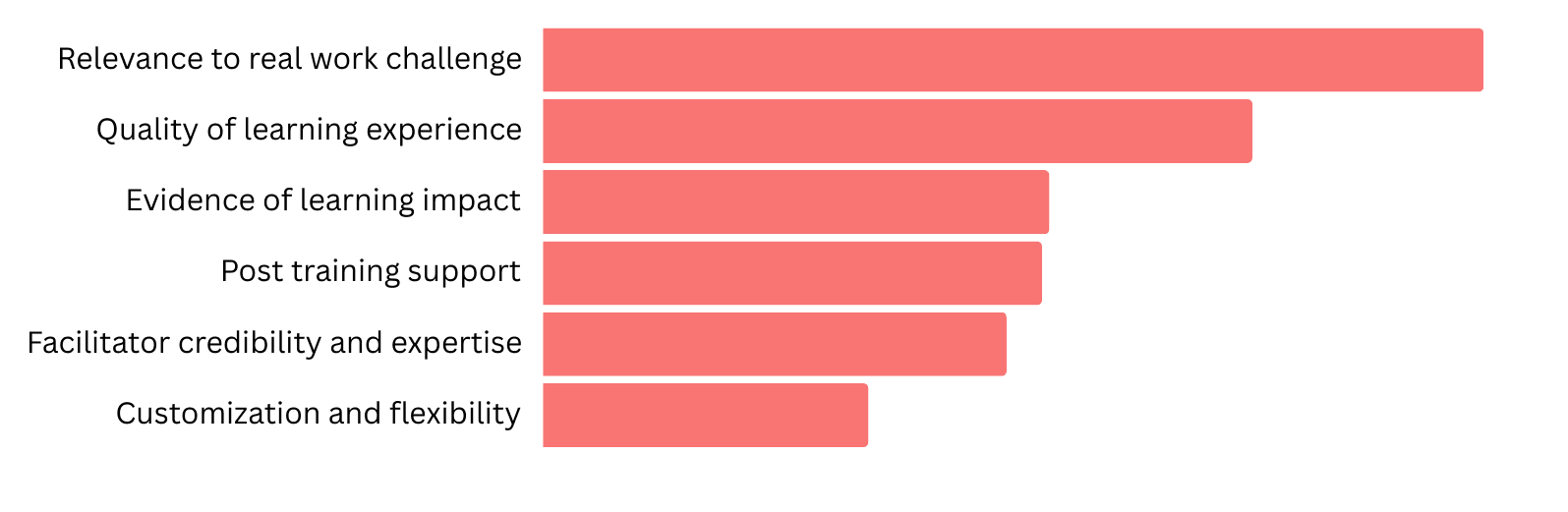

77% will choose providers based on relevance to real work. Post-training support is no longer optional – it’s a differentiator.

As respondents look toward 2026, relevance to real work challenges emerged as the most influential factor in training provider selection, cited by 76.9% of respondents. This was followed by quality of the learning experience (58.0%).

Evidence of learning impact (41.4%) and post-training support (40.8%) also ranked highly, indicating that future provider selection will increasingly emphasize outcomes beyond delivery. Facilitator credibility and expertise was selected by 37.9%, while customization and flexibility accounted for 26.6% of responses.

Factors such as cost versus value (20.7%) and recommendations or reputation (15.4%) were selected less frequently, positioning them as secondary considerations rather than primary decision drivers.

Implications for Training Providers

The findings of this report point to several clear implications for training providers (internal or external) seeking to remain competitive and relevant in 2026. First, training delivery alone is no longer sufficient. Providers will need to design learning as an end-to-end experience, with explicit consideration for reinforcement, application, and post-training support.

Second, relevance and customization have become baseline expectations, not differentiators. Programs that are generic or overly standardized are less likely to meet evolving buyer criteria. Providers must demonstrate an ability to tailor learning to specific roles, industries, and organizational contexts.

Third, facilitator credibility is a critical asset. Providers should be able to clearly articulate the practical experience and expertise of those delivering training, as this remains a key factor in both positive learner experiences and future provider selection.

Finally, evidence of learning impact will increasingly shape purchasing decisions. Providers that can articulate how learning translates into improved performance, capability, or outcomes will be better positioned than those who focus solely on content coverage or delivery volume.

As the learning ecosystem continues to mature, training providers that align their offerings with these expectations will be better equipped to function not just as vendors, but as strategic partners in organizational and individual development.

Conclusion

The 2025 data presents a learning ecosystem that is active, largely effective, and increasingly intentional in how training is sourced and evaluated. Training delivery is predominantly local, with strong reliance on in-house L&D teams, independent facilitators, and online platforms. Learners report positive experiences overall, particularly when training is relevant, engaging, and delivered by credible facilitators.

At the same time, persistent challenges around post-training follow-up, session design, and application signal areas where expectations are not yet fully met. As organizations move into 2026, training provider selection will be shaped less by brand or scale and more by relevance, impact, and sustained learning support. Providers that align with these expectations will be best positioned in the evolving training landscape.

Share this report with your network